Living Wage Foundation Director, Katherine Chapman, said:

"Millions of workers are struggling to make ends meet, with too many facing tough decisions over whether to heat their homes or pay for food. Raising the minimum wage will be welcome respite to many, but given this is pegged to average earnings, which are now stagnating, this is unlikely to be enough. With rising costs also eating into people's pay packets, a real Living Wage, based on the cost of living, is more important than ever.

"There are now over 3,700 Living Wage employers who choose to go beyond the legal minimum and pay a real Living Wage. These organisations are putting fairness and respect at the heart of their business. It is vital that all politicians continue to support and encourage those employers who can afford it, to do the right thing, and deliver a fair day's pay for a fair day's work."

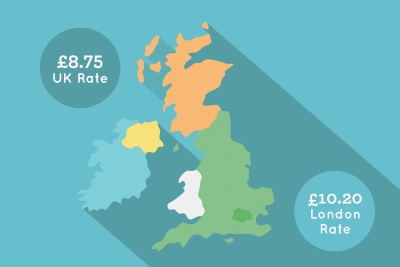

Earlier this month the real Living Wage was raised to £10.20 an hour in London and £8.75 for the rest of the UK, providing over 150,000 workers with a pay rise. Despite this, the 2017 Living Wage report for KPMG, published prior to the announcement of the new rates, found that one in five people (21 percent) in the UK are still earning below the real Living Wage, meaning that an estimated 5.5 million employees are struggling to get out of in-work poverty, with 62% of those earning less than the real Living Wage being women.

More than 3,700 employers are now signed up to pay their employees a fair day’s pay for a fair day’s work, with accredited organisations including over a third of the FTSE 100, household names such as Heathrow Airport, Somerset House, IKEA, Aviva, Nationwide, Chelsea and Everton Football Clubs and Google, as well as thousands of small businesses, who are choosing to pay the real Living Wage to ensure all staff, including onsite contractors, earn a wage that meets the real cost of living.

The Living Wage rates are independently calculated, based on the real cost of living in the UK and London. The 2017 increases have been largely driven by higher inflation feeding through to the basket of goods and services that underpin the rates, with rising private rents and transport costs also having an impact.